Watertown residents were not overcharged on the CPA surcharge on their tax bills, City officials said, but bills in fiscal year 2025 looked different from other years, leading to the appearance that they were calculated differently.

The issue came to the Administration’s attention when former City Councilor Angeline Kounelis sent a letter after she could not figure out why her FY2025 bill was different from previous and later years. It appeared that the CPA surcharge was applied to the entire property value, before the residential exemption was applied.

It wasn’t a matter of new math, but rather new computer software, according to the explanation video produced by Watertown Community Engagement Specialist Tyler Cote.

“It’s really just taking two different paths to the same end,” Cote said. “And, I’d like to assure nobody’s been overtaxed in this case, the numbers looked a little bit different due to our new software that our assessing team was using and two softwares we use not communicating particularly well together.”

The City’s Assessing Department uses an online system for assessments of properties which connects directly with a different online system that formats and prints the residential tax bills, the announcement on the City of Watertown’s website said. In Fiscal Year 2025, the Assessing Department switched to a new online system that did not connect properly with the online tax bill system.

As a result, the residential exemption was placed in a different box on property tax bills.

“Though this appearance can give the impression that taxes were being calculated prior to exemptions being applied to the property, this is not the case and is the product of some technology issues and creative solution building by the Assessing and Treasury team,” the City announcement said. “The (City’s) Treasury and Assessing Departments worked hard to ensure that all bills were correct in their required payment, with all exemptions applied appropriately, however some of the calculations and taxes appeared larger on some areas of the bill — for example the total real estate tax and the CPA tax.”

The City created a video showing step by step how the taxes and CPA surcharge were calculated in different years.

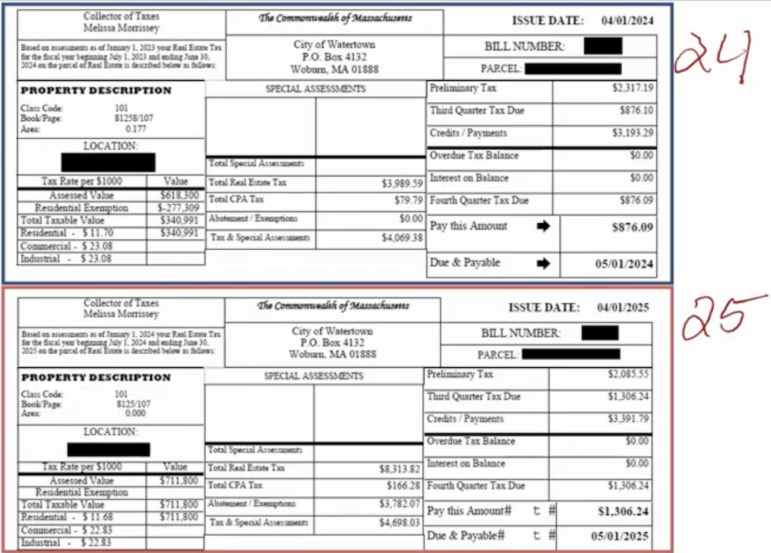

In the example below, from the City’s video, the FY2024 bill lists the Residential Exemption on the left most column, under Assessed Value. When you subtract the Exemption from the Assessed Value, you get the Total Taxable Value. That amount is used to figure the Total Real Estate Tax in the second column. The CPA is a 2 percent surcharge of the Total Real Estate Tax, which can be seen in the second column. Add the CPA Tax to the Real Estate Tax and it gives the grand total owed, or Tax & Special Assessments figure.

For FY2025, the Residential Exemption appears not in the first column, but in the second one in the box next to Assessment/Exemption. That figure also includes a reduction on the CPA Assessment due to the Residential Exemption. To calculate the total owed, you have to start with the Total Real Estate Tax, which in this case was based on the Assessed Value prior to removing the Exemption. The 2 percent CPA surcharge is also based on the total Assessed Value. The combined Residential Exemption plus the reduced amount of CPA surcharge (based on the Exemption) is then subtracted from Total Real Estate Tax to come up with the Tax & Special Assessments, or total amount owed.

To view the video, and the City’s announcement, go to https://watertown-ma.gov/1084/City-Manager-Updates

For questions or more information contact the City of Watertown’s 311 Service Center by calling 311 or 617-715-8660, or go to https://watertown-ma.gov/1326/311-Service-Center

Dear East Enders and neighbors beyond,

I share with you my response to City Manager Proakis, as follows:

Greetings George:

Many thanks to you, and your Team, for the followup explanation for the calculation of the FY 2025 CPA Tax. As we discussed, during our impromptu meeting, it would have been easier, had the unknown factors been made available at the onset of the FY 2025 real estate tax process.

To my knowledge: there was no notification that there was an internal challenge, associated with a “software bridge”. The onus was placed on the property owners to delve into the 12/10/2024 Real Estate Tax Classification presentation (https://watertownma.portal.civicclerk.com/event/5634/files/attachment/1455), for the base numbers. As the numbers were presented on the Real Estate Tax bill; there were too many unknowns.

Anticipate, before the fact. We all learn; by asking questions. Once again, thank you for filling in the blanks.

Best,

Angie

Angeline Maria B. Kounelis

Retired District A, East End, City Councilor

Take The Initiative To Make A Difference

Participate In The Process