One issue heard often during the 2017 Town Election was residents wanting more relief on their residential property taxes. The Town Council took a step toward cutting bills by increasing the residential property tax exemption by one percentage point on Tuesday night.

The residential exemption will be 23 percent in Fiscal 2018, which means owner occupied properties can get a break on taxes, but properties where the owner does not live or is not the primary residence will bear more of the burden.

The annual property tax of the average valued owner-occupied home (assessed at $587,413) will be $6,092.59, which is up $160.43, or 2.7 percent. This year, for the first time, the Community Preservation Act (CPA) assessment will be added on for the first time. With that, the bill for the average property will go up an additional $121.85 for a total of $6,214.44, up a combined 4.76 percent.

A non-owner occupied home of the average value would have an annual tax bill of $7,912.45, an increase of $308.12 (4.05 percent). With the CPA it would be up another $158.25 for a total bill of $8,070.70, an increase of 6.12 percent.

Town Assessor Francis Golden presented the Council with information about a range of options, from keeping the exemption of 22 percent to increasing it to 25 percent.

The recommendation of the Board of Assessors, which Golden chairs, was to keep the exemption at 22 percent because the increase for both owner occupied and non-owner occupied would be about the same – a 3.27 percent increase for both.

Golden said the residential exemption gives the Town Council the ability to control tax increases for some residents – those living in the homes they own. He recommended using it in certain situations.

“It is an important tool that the Town Council has the residential exemption when the market goes down and taxes increase,” Golden said, adding that prices are increasing in the current market. “This is the second lowest percentage increase for both (owner occupied and non-owner occupied).”

Council Debate

Town Council President Mark Sideris suggested the Council keep the exemption at 22 percent.

“Last year the Assessors made the recommendation to increase. We probably don’t want to go too much further than that, because fact is the situation doesn’t warrant that kind of increase,” Sideris said. “The residential exemption is for when property values go down and we don’t have growth.”

District A Councilor Angeline Kounelis said that she has lost count of the number of years she has pushed for increasing the residential exemption to 25 percent. She noted that while the cost of two-family homes in Watertown have increased greatly, she knows of a number of families in her district, in the East End, who bought a two-family so that parents or children can also live there.

“The don’t pay rent, they do not generate revenue,” Kounelis said.

District D Councilor Ken Woodland said he would advocate for increasing the exemption to 23 percent. Along with keeping the increase a bit lower, it would also help residents deal with the increase due to the CPA.

“Last year we increased it from 20 to 22 percent. The tax increase would have been $267, instead it was $192. People saved about $175,” Woodland said. “This year if we go from 22 to 23 percent the person would save about $38. Over two years they would save about $113, just about same amount as the increase as a result of of the CPA.”

Councilor At-Large Michael Dattoli noted that he heard from many people who want tax relief, but said that it is a tough decision because decreasing one person’s bill will increase another person’s.

Councilor At-Large Aaron Dushku said he worried about increasing the exemption to 25 percent would hurt those renting in Watertown because the non-owner occupied properties would increase much more than those getting the exemption.

The Council voted down a proposal to keep the residential exemption at 22 percent by a vote of 6-3, with Sideris, Vincent Piccirilli and Tony Palomba voting “yes.” Then they voted 8-1 in favor of increasing the residential exemption to 23 percent, with Kounelis voting “no.”

Not All Properties Taxed the Same

Golden stressed that the average tax bill is not what everyone pays. Also, some do not benefit from the residential exemption.

There are even a large number of properties, 16 percent, which will not have a tax increase this year, Golden said.

Homes valued over $1 million will not get any benefit from the residential exemption even if they are owner occupied, in fact they will pay more than if there was no exemption, Golden said.

The increase also depends on the type of property, the neighborhood and whether improvements have been made to the home. When prices go up, so do the assessed values and in turn the property taxes.

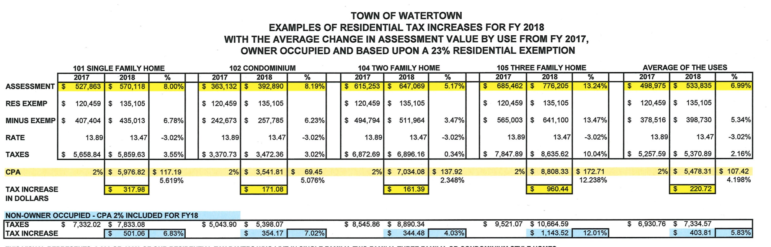

The type of properties going up most this year are three-family homes. With the 23 percent exemption, the average bill will go up 10.04 percent and 12.238 percent with the CPA for a total increase of $960.44.

Two families, which had large increases in recent years, will get a much lower increase this year. With the 23 percent exemption, the increase is only 0.34 percent, and with the CPA it is 2.348 percent higher, for a total increase of $161.39.

Single family homes will see a 3.55 percent increase under the 23 percent exemption. With the CPA it will be up 5.619 percent – a total increase of $317.98.

Condos will be slightly lower, with an increase of 3.02 percent. The increase with the CPA is a total of $171.08, a 5.076 percent increase.

See the entire Fiscal 2018 tax classification hearing presentation document by clicking here.

I would like to know how the town plans on handling the scores of properties that are generating substantial income through airbnb and other house share type applications. are they being taxed accordingly? Many of these airbnb’s are not even legally zoned apartments.

We can vote for new leaders in the 2018 election cycle.

Makes me laugh when some councilors stated they were concerned that increasing the exemption may cause rents to rise, and they themselves had supported the CPA ballot question. I just cannot see the logic.

Fred, please contact me at 617-999-5333 or michaeldattoli@gmail.com. I am hearing a lot from residents in the past few weeks about short term lodging / rentals in Watertown. https://www.airbnb.com/help/article/376/what-legal-and-regulatory-issues-should-i-consider-before-hosting-on-airbnb

Jack, Watertown just completed the 2017 general town election. There will not be another election to vote for new leadership until 2019.