Charlie Breitrose

Watertown’s Town Hall.

Watertown homeowners noticed a new line on their property tax bills, the one for “CPA Tax.” The new tax is on all bills, but some residents can qualify for an exemption on the new tax.

The tax is the surcharge for the Community Preservation Act, which was passed by voters in 2016. The money raised by the tax will go into a fund earmarked for projects related to affordable housing, open space/recreation and historic preservation.

The CPA adds a 2 percent tax surcharge. The “good news” is that most years the tax on the quarterly bill will not be as high as the first two bills in 2018. Those bills are actually the third and fourth quarter bills for Fiscal Year 2018, and according to the Watertown Assessor’s Office because the surcharge was not added in the first two bills the entire surcharge for FY2018 went on the last two bills of the fiscal year.

Residents who qualify as “moderate” or “low” income can qualify for an exemption if they meet the following criteria:

1. Applicant must own the property as of January 1, 2017. May be (1) sole owner, (2) co-owner, (3) life tenant or (4) trustee with sufficient beneficial interest in property under terms of trust.

2. Applicant must occupy the property as primary residence as of January 1, 2017.

3. Applicant and each co-owner must have household income for the calendar year before January 1, 2017 at or below the limit for that owner’s household type and number. For property subject to trust, each co-trustee must meet income standard.

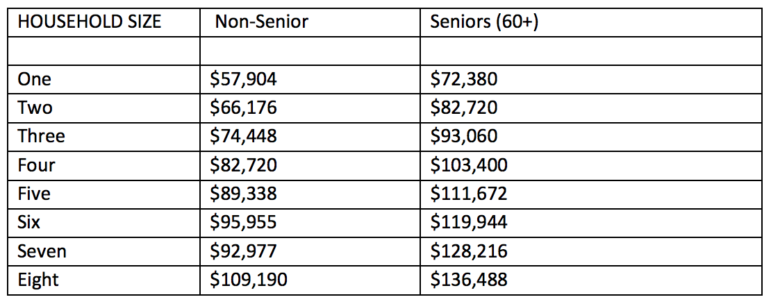

The qualifying income for seniors – age 60 or older – is higher than for non-seniors.

Household income limits for CPA Exemption:

Income is based on the annual gross income from all sources, then deduct $300 for each dependent and deduct the medical expense exclusion. See more details in this document from Town of Watertown by clicking here.

The form to apply for an exemption can be found by clicking here. The deadline for applying for the CPA exemption is April 1, 2018.

If you have questions you can contact the Assessor’s Office at 617-972-6410. Also, on Jan. 10, 2018, the Watertown Senior Center will be hosting a presentation on taxes and exemptions, including the CPA tax. Fore more information go here http://www.ci.watertown.ma.us/DocumentCenter/View/23710. Call the Senior Center to preregister at 617-972-6490.