Tuesday night, the Town Council will hear the annual Tax Classification hearing presentation from Town Assessor Earl Smith, which calls for increasing the break given to owner-occupied homes and condos in Watertown.

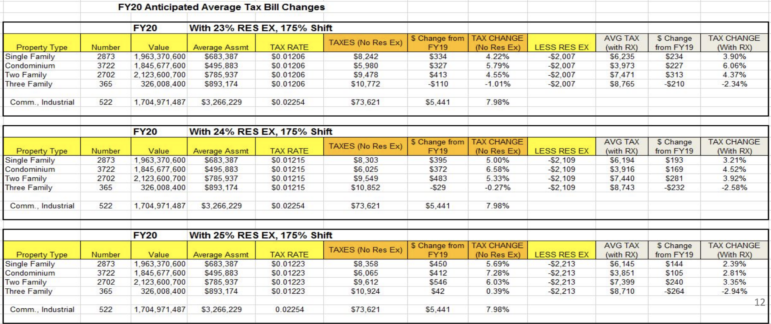

According to the Assessor’s presentation the recommended tax rate for Fiscal Year 2020 will see bills go up between $169 and $281 for owner occupied properties which receive the residential exemption, and three-family homes would actually see their bills go down.

Smith’s presentation includes a recommendation to increase the residential exemption, which is given to homes which are the primary residence of the owner.

“The Board of Assessors recommends increasing the residential exemption

to 24 percent for FY2020. The Board’s intention, at this time, is to further

recommend an increase in FY2021 to 25 percent. For FY22 and beyond, the

Board would review the impact of any debt exclusion or override and

consider recommending a more substantial increase to partially offset any

tax increase for owner occupied residents,” the Assessor’s presentation reads.

The Town may be passing a debt exclusion beginning the next couple years to help pay for the Watertown High School project.

Residential Exemption

With a 24 percent residential exemption, $2,110 would be reduced from property taxes for qualifying properties. This would result in an annual bill of $6,682 for the average valued home in Watertown (assessed at $723,586) with the residential exemption, and would be an increase of 4.66 percent. Without the residential exemption, the bill for the same property would be $8,792.

Smith notes that the residential exemption is not equal for all.

“Because the reduction is the same fixed amount (% of the average residential assessment) off every bill, lower assessed properties reap more of the benefit by having a larger percentage of their taxes reduced,” the presentation reads.

Also, properties valued at $1.174 million or more will not get the exemption, and investment properties are billed at a higher rate, even if the owner lives in town in another property.

The residential exemption does not kick in until the next year (i.e. home buyers that purchase for the first time after Jan. 1, 2019 qualify for FY21, but miss FY20). Also, if a person still lives in the home, but has transferred it into a trust, the property does not qualify for the exemption.

This is not the first time the residential exemption has been boosted. Three years ago, the Town Council voted to increase the amount of the residential exemption from 22 percent to 23 percent beginning in FY 2018. That change came just a year after increasing it from 20 percent to 22 percent.

The presentation also calls for continuing the 175 percent shift from residential properties to CIP (commercial, industrial and personal properties). The rate for residential properties would be $12.55 per $1,000 of assessed value (before the residential exemption) with a 175 percent shift, and CIP rate would be 22.54.

Taxes by Property Type

The change in bills depends on what type of property is being assessed.

Assuming the 175 percent shift to CIP and the 24 percent residential exemption are adopted, the average single family home’s bill, after the exemption, would go up $193 (3.21 percent) from FY 2019 to $6,194. This is based on a home valued at $683,387. Without the exemption, the average single family home bill would be $8,303, which would be up $395 or 5 percent.

For the average condo, worth $495,883, the annual bill with the residential exemption would go up $169 (4.52 percent) from the previous year to $3,916. Without the exemption the bill would be $6,025, which is up 6.58 percent or $372.

The bill would go up $281 (3.92 percent) for the average two-family home (valued at $785,937) with the residential exemption. Without the exemption, the bill would be $9,549, up $483 or 5.33 percent.

The bill for the average three-family, valued at $893,174, with the exemption would be $8,743, which is down $232 or 2.58 percent. Without the exemption it would be down $29, or 0.27 percent, to $10,852.

The Town Council meeting begins at 7:15 p.m. on Tuesday, Nov. 26 in the Council Chamber in Town Hall, 149 Main St. The Assessor’s presentation can be seen by clicking here.

Why is the town looking at home owners to get the money for the new high school instead of looking at all these new condos in town.

Leave the long time townies alone and target the new comers.

Good question. The tax rate is the same, but the bills are based on property values. So condos are worth less and houses are increasing in value more. Also most of the new housing are rentals.

Charlie, I find the wording of your statement somewhat misleading. Typically, yes, the average condo might be worth less than your average single-family home in town, but both homes and condos are definitely increasing in value. Also, correct me if I’m wrong, but wouldn’t properties, whether they are rented or owner occupied, pay the same amount in taxes? With a rental property, it’s just that the owner (rather than the renter) is responsible for the tax burden. That said, because of the residential tax exemption, rental properties should theoretically generate MORE tax dollars for the town than owner occupied because they AREN’T exempt, no?

I know that a lot of folks in town aren’t crazy about the large condo complexes but, from a tax revenue generating standpoint, they are perhaps becoming one of the bigger boons to the town’s tax base. I base my assumption the following:

1. Most are occupied by couples without children or empty nesters. The largest expendenture on an average town’s budget is education. In Watertown, education accounts for approximately 45% of the total budget. More homes with fewer children in them = more money for the town.

2. Most brand new 2-bedroom condos sell in the 600-700K range. Taxes are based on a mill rate (percentage of total value). Watertown’s mill rate is $12.88 (which is quite competitive when compared to surrounding towns, many of which have higher average priced homes). Nicer/pricier condos equates to more revenue for the town.

3. Condos are “stackable” and typically require much less land than a standard single family home. More homes in a small parcel of land also therefore equates to more tax revenue for the town.

Again, I’m not here to discuss traffic congestion, aesthetics, loss of town character, etc., etc. but simply tax revue derived from residences. That’s another discussion for another time.

Thanks for your comment. You can see more details about prices, increasing values and numbers of each type of properties in the presentation linked in the story. Rentals are taxed a bit higher than owner occupied due to the residential exemption. I am just not certain how the rate for the large buildings on Arsenal and Pleasant.

I have seen more than ten single family homes torn down within a two block radius of my home in recent years. All have been replaced by grossly oversized high end duplex condos with selling prices >$800K to over $1M per unit. I have lived in Watertown my entire life and plan to retire in a few years but the trend here is to price out all long term residents on fixed incomes by ever increasing property taxes. That means more teardowns and more crammed in condos and the eventual extinction of the single family home in Watertown. And of course many more cars for which there is not enough off street parking. I thought all of the relentless and endless building going on both retail and commercial would generate enough revenue to stabilize the tax burden on the long term single family property owners. I guess the Town Council has other ideas.