Watertown Assessor Earl Smith had some good news for the City Council Tuesday night that new development has brought in several million in new tax dollars. However, what stood out most was the bad news that he had for homeowners — a property tax increase for Fiscal Year 2022.

The new life science developments in Watertown will bring in millions of dollars of new tax revenue for the City but due to the restrictions of the state law regarding shifting the tax burden away from residential properties, the average residential tax bill will rise by $287 or 4.3 percent, Smith said.

The total tax levy for the City of Watertown in Fiscal Year 2022 will be $134.4 million, Smith said.

The increase would have been more if the Council did not approve an increase in the amount of the Residential Exemption, given to owner-occupied properties. The residential exemption will go from $2,247 to $3,012.

Councilor Angeline Kounelis called the tax increase on homeowners despite the development in town “a difficult pill to swallow.”

“It is difficult. We as Councilors must be able to communicate to the general public, as they see all of the growth and development going on all around the community and all the associated distresses,” Kounelis said. “It is not easy to tell folks, well, it is a formula and even without this money coming in the formula tells us we are in fact going to see major real estate tax increases and to see this is not going to change within the coming years.”

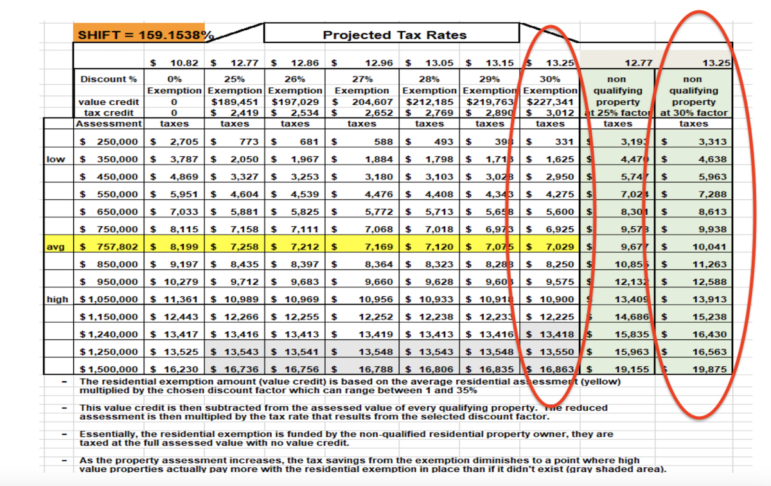

Watertown Assessor’s Office

The tax rates for Fiscal Year 2022, circled in red. Left is for homes with the residential exemption and right is for non-owner occupied properties.

The tax increase will be even higher for rental properties, with tax increases of 10 to 12 percent as a result of the residential exemption, Smith said.

Councilor Tony Palomba said he worries that the increase in taxes on non-owner occupied properties will mean rent increases for tenants.

The increase is bad news for property owners, said Council President Mark Sideris.

“I want to echo what Councilor Kounelis said, and touch on what Tony said. For those of us who have served for a long time we always thought all this growth would bring some relief to the residential tax payer, and it’s not doing that,” Sideris said.

He added that he wants the Council and the City Administration to look for ways to give people more relief, because the City cannot take full advantage of one major form of relief — the tax shift from residential to commercial, industrial and personal (CIP) properties.

“Now we are getting more bad news that can’t do 175 percent shift anymore because of all the commercial, industrial growth,” Sideris said.

Smith said the State law allowing communities to shift the tax burden limits the amount that can be shifted to CIP properties to 175 percent of their full and fair cash value. Also, residential properties must pay the greater of either 50 percent of the total tax burden or the lowest percentage share of the tax levy a community has paid since classification began.

In Watertown’s case, the lowest percentage paid was 61.242 percent, and using that to do the calculation the most it can shift is 159.1528 percent, Smith said.

The situation of not being able to shift the full 175 percent will likely continue for several years, Smith said. Watertown is projected to see increases in CIP property values by around $1 billion over the next 5 to 7 years, and he does not believe home values and new residential developments will keep pace.

Councilor Anthony Donato asked if any communities had successfully petitioned the State to change the way that the shift to CIP properties are calculated to provide more relief to homeowners. Smith said he is not aware of any community that has done so.

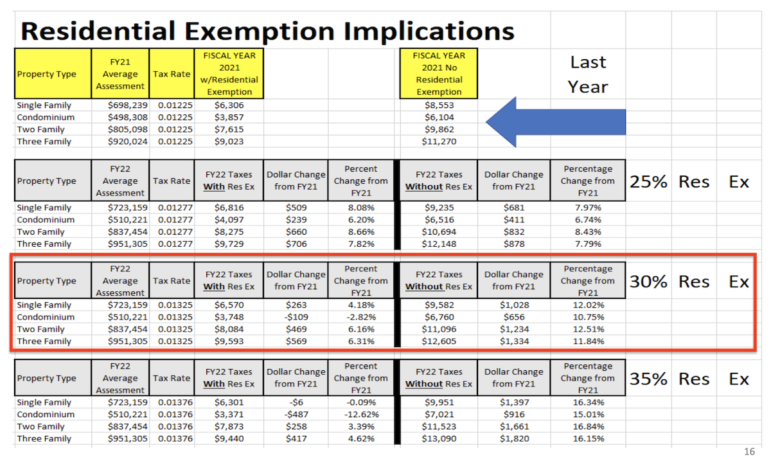

Watertown Assessor’s Office

The impact of the 30 percent residential exemption passed by the City Council on Tuesday. Last year Watertown had a 25 percent exemption, and the maximum allowed is 35 percent.

To lessen the impact of the reduction in the property tax shift, the Board of Assessors recommended increasing the residential exemption from 25 percent to 30 percent. The increase with a 25 percent exemption would range from 6.2 to 8.66 percent depending on the property type. With a 30 percent exemption, one property type, condos, will have a 2.8 percent decrease, and others will increase 4-6 percent: 4.18 percent for single family homes, 6.16 percent for two-family homes, and 6.31 percent for three-family homes.

The residential exemption is calculated by first dividing the total residential value of the community by the number of residential properties to find the average value. In the case of Watertown in FY22 it is $757,802. Then the percent of the exemption is used to come up with the exemption amount, Smith said. Taking 30 percent of the average value means the residential exemption comes to $3,012. This amount is taken out of the tax bill regardless of the property value.

The Board of Assessors also looked at how much relief could be provided if the Council adopted the highest residential exemption rate, 35 percent.

Smith said the rate would be significantly lower for owner-occupied properties, but would rise even higher for non-owner occupied ones. Also, the relief would not be available in future years.

“Our feeling is it would give some properties tax relief for one year, but it is going to absolutely croak 3,900 properties in this community that do not have the residential exemption, which would have tax increases between $900 to $1,800 — 15 to 17 percent increases,” Smith said

See the Watertown Assessor’s slide presentation from the Fiscal Year 2022 Tax Classification Hearing by clicking here.

Tax Exemptions

Residents living in the home that they own as their primary residence can apply for the Residential Exemption.

There are also other exemptions for seniors, veterans and some people with disabilities. The City Council also adopted the maximum amount of exemptions allowed by the state for the exemptions. The amounts available are:

- Qualified surviving spouses and Seniors over age 70: $350

- Qualified Disabled Veterans and surviving spouses: $800

- 100 percent Disabled Veterans: $2,000

- Blind Persons: $1,000

- Qualified Seniors Over Age 65: $1,000

Last year, Watertown gave 163 exemptions for a total of $169,965, Smith said.

Find out more information about exemptions at the Watertown Assessor’s Office in City Hall, 149 Main St., Watertown.

New Growth

The new growth is the increase in property values from the previous year. The growth during Fiscal Year 2021 was $7.89 million. That along with the 2.5 percent increase over last year’s tax levy allowed by the state will add almost $11 million to the previous year’s total tax levy, Smith said.

The COVID-19 Pandemic adversely impacted the values of most property classes in Watertown (including both residential and the CIP), but one area has skyrocketed which led to a large increase in new growth, Smith said.

“Six of the categories are lower than the three-year average. COVID has been a problem. It played a problem with construction, a number of businesses have gone out of business. Certainly it played a role in those numbers, but, life science has gone up five fold,” Smith said. “The three-year average (growth) was $1.16288 million. It is $5.5 million this year. That significant increase, that is what has saved the new growth number. That is where the market is at the moment.”

My understanding from Mr. Smith’s presentation on resident tax rates is: the formula mandated by state law can favor resident tax rates if we build more affordable housing. More of a resident tax base, changes the tax burden requirements relative to commercial property owners. It would be interesting to know what the tipping point is. How much more resident property is needed to allow the tax burden be shifted away from residents and, once again, more towards corporations?

I’m glad the new Housing Trust will be promoting more housing. This will help our tax rates.

In all of this talk about rates going up, I don’t hear about what is demanding the need to spend more? I for one have not seen or heard that we are getting more for this increase in taxes.

The cost of government is like the cost of anything else. It increases every year due to wage increases and inflation.

Yes, town council, we have been trying to tell you for years that all this development does not bring in a tax panacea. All this development just brings in more expenses such as new roads, more public employees such as police and firefighters and school teachers. We have to fund all of that plus retirement for all these outstanding employees not to mention all the new schools and public buildings that need to be updated. TC, you need to look at long term tax relief and solutions for this town instead of taking the short term, easy road. Do better for all of your citizens!

Never heard anyone say it’s a panacea. But it certainly has helped the finances of the Watertown government. Building new schools without a Prop 2 1/2 override vote didn’t just happen!

I hope the city builds more affordable housing because with the tax increase and the water and sewer rates going up more of us are going to need it.

I recently read a resident’s very reasonable response to the possible increase in our taxes. And, in theory, that’s exactly the way we should view our taxes…doing our fair share for our collective good as a community. It makes sense. If we all contribute, we all do better. But here’s the problem…

Big developers have entered the mix. And as 3.7 million square feet of construction for bio labs in Watertown is “planned,” (according to the Globe) even as this industry is shrinking, we Watertown residents have dealt with more traffic, more pollution, more rodents and less response from our local government to our neighborhoods’ needs.

The only “payback” that the City Council has been touting for all of this mayhem is lower taxes, and now taxes look to be going up!

Here’s another concern that I have. In East Watertown, the small businesses have taken some major “hits”. Arsenal Yards has drawn people away. The bio lab going into the Tufts building has eliminated all of those workers as shoppers. That as well as the construction on Mt. Auburn Street is a perfect storm for our developer “friends” at the Arsenal Yards and Alexandria, et al to pick off these weakened businesses one by one, like a slow rolling fire sale.

Here’s what I personally pledge to do:

Fastachi will be a great place to get my friends and family their Christmas gifts.

I have a vegan friend that I plan to share a holiday meal with at Red Lentil.

I have some house projects that I plan to use Coolidge Hardware to provide the materials.

I hear there’s a great Thai restaurant in Coolidge Square that I plan to use as a takeout place. (I really miss my place in Watertown Square).

What can YOU do to support your local community? Lately, it seems that we can’t count on our taxes to make a difference, at least not for you and me and the small businesses that we value so highly here in Watertown. So, we can make the small contributions to small businesses that we can, and at the same time, benefit from their wonderful service.

Happy Holidays!

Thanks Linda I’m with you, Happy Holidays to you as well!