A State law that allows cities and towns to shift the tax rates from residential properties to commercial and industrial properties also stands in the way of providing as much relief to homeowners as the City Council would like.

Last week, the City Council adopted the new tax rate with a split tax rate and residential exemption that would increase the average annual tax bill by $309 or 4.4 percent.

State Law’s Impact on Watertown Taxes

Proposition 2 1/2, which is known for limiting the overall tax levy increase to 2.5 percent per year, also allows for some relief of up to residential property owners. Watertown City Assessor Earl Smith told the City Council on Nov. 22 that the law also limits how much can be “shifted” onto CIP (commercial, industrial and personal) properties.

For years, the Council adopted the maximum shift of 175 percent. Last year, however, the maximum shift available was 159 percent, Smith said.

The law allows CIP properties to pay up to 50 percent of the total tax levy, that is, unless the residential portion was above 50 percent when Prop. 2 1/2 came into effect. In Watertown’s case, the law limits the maximum shift by requiring residential properties to pay a minimum of 61.24 percent of the total tax levy, making the maximum CIP can account for at 38.76 percent.

In recent years, a dramatic change has been seen in the assessed values of commercial and industrial properties, Smith said, which outpaced the increase in value of residential properties.

“The commercial, industrial, personal class is growing at a fast clip. What happens is if we shift the commercial, industrial 175 percent we start to exceed the 39 percent that’s allowed,” Smith said. “Last year, if shifted 175 the residential class would pay something like 57 percent of the taxes, by law the residential class — their burden — is a minimum of 61.24 percent, dating back to classification, dating back to the ’80s.”

Watertown Assessor’s Office

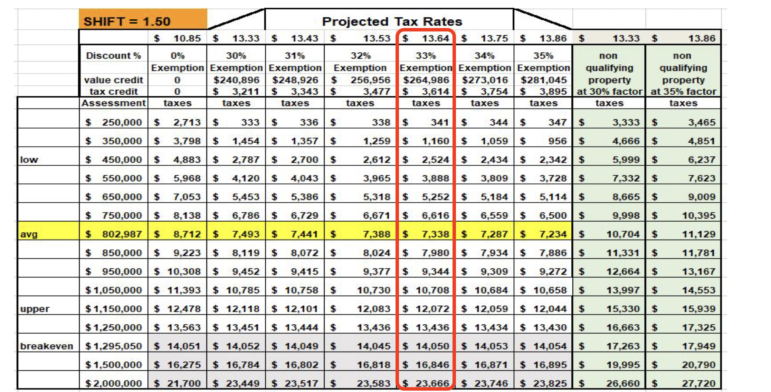

The rate adopted by the City Council for Fiscal Year 2023 is show in the red box.

The minimum portion to be paid by residential properties, the 61.24 percent, was set when taxes were first classified, Smith said.

City officials have tried to change the formula to allow Watertown to use the 50/50 split, said City Manager George Proakis. Over the summer, the City Council voted to file a Home Rule petition at the State House, which if approved by the Legislature and signed by the governor, would change the rule for Watertown.

“Our legislative delegation has been working very hard to move that Home Rule petition through the Legislature,” Proakis said.

The Legislature is currently in its informal session, during which legislators can be passed, but just one vote against means it fails. The Legislature has had questions, which Smith said he has done his best to answer. The area is not something that many, if any other communities, have gone dealt with besides Watertown, so it is not familiar to most in the State House.

“Certainly the Manager has been in conversation and I’ve been in conversation and I’ve given answers and tried to clarify things,” Smith said. “It is a very obtuse subject and a lot of other senators and representatives of other communities, sometimes they don’t even believe there is a minimum percentage. Each community has a minimum percentage, it is based on where your community was when Prop. 2 1/2 came into effect. No two communities are the same for the minimum percentage.”

Average Taxes

Smith presented the average bills in FY23 for different types of properties with the split tax rate of 150 percent and 33 percent residential exemption adopted by the Council.

For a single family home, the average tax bill will be $6,858, up $398 or 6.06 percent. The average value of a single family is $775,833. Without the exemption the bill would be $10,582 (up $1,001 or 10.44 percent).

The average condo (valued at $548,372) with the exemption will have a bill of $3,865, which is $117 or 3.13 percent higher. The bill without the exemption will be $7,480, an increase of 10.64 percent ($719).

The average assessed value of a two-family home is $881,526, and the tax with the exemption will be $8,410, up $326 or 4.03 percent. The bill without the exemption will rise $928 to $12,024, a 8.36 percent jump.

For three-family homes, the average tax bill with the residential exemption will be $10,151, which is $558 (5.82 percent) higher. The bill will be $13,765 without the exemption (up $1,160 or 9.21 percent).

Watertown Assessor’s Office

The rates for the Fiscal Year 2023 Watertown property taxes can be seen in the red box.

Residential Exemption

In order to provide some relief, Smith said, and to keep the tax increase closer to the median increase over the past few years (about 4.4 percent) the Board of Assessors recommended increasing the residential exemption from 30 percent to 33 percent.

The exemption is available to people who own a home in the City and make it their primary residence. The amount is a percentage of the average residential property value, which is $802,987. At 33 percent the residential exemption is $3,614, which is $602 above last year. The taxes on the average priced home with the residential exemption will be $7,338, up $309, or 4.2 percent. Without the exemption, the bill on the average home is $10,953, up $912, or 9 percent.

The City can go up to a 35 percent residential exemption, Smith said, but the Board of Assessors recommended (and the Council adopted) a 33 percent exemption. There are a couple reasons the Board did not recommend the full 35 percent.

“It is a little more equitable, it falls in line with the median increase. Last year we had this same discussion,” Smith said. “If we had gone to 35 last year we would have nothing to go to this year to keep it within the median increase (4.4 percent).”

All qualifying homes will get the $3,614 reduction in property taxes, regardless of assessed value, Smith said. This means the biggest impact is on the lower end of the property values, and because the exemption is paid for within residential properties there is a price point where the taxes would be lower if there was no residential exemption, In Fiscal Year 2023 that point is on properties assessed at $1.29 million or higher.

Also, the taxes are higher for what Smith called “investor properties.” These are homes which the owners do to make their primary residence. There are a few other exemptions, including if someone puts a home in a trust, which means officially the trust is the owner not the resident.

There are about 10,000 residential properties in Watertown, Smith said, and about 6,200 get the residential exemption, and about 3,800 are not. The deadline each year to apply for the residential exemption is April 1. See more at the Watertown Assessor’s webpage (click here).

How the Rate is Set

Each year the new tax rate is set by taking the previous year’s tax levy limit, adding 2.5 percent allowed by Prop. 2 1/2, and adding the new growth.

In Fiscal Year 2023 the levy limit is $144,133,270. That is $134,418,141 (the FY22 levy limit) plus $3,360,4545 (2.5 percent) plus $6,354,675 (new growth).

The rate without a shift to CIP or residential exemption would be $13.16 per $100,000 of assessed value. This is calculated by taking the tax levy and dividing it by the total total assessed value of properties in town.

With the 150 percent shift to CIP, which creates the split tax rate, the residential rate is $10.85 per $100,000, and CIP is $19.74 per $100,000. That is before the residential exemption. With the 33 percent exemption, the residential rate is $13.64 per $100,000, and the properties with the exemption have their tax bills reduced by the $3,614 exemption.

Watertown Assessor’s Office

Projected Fiscal Year 2023 Watertown tax rates based on assessed value can be seen in the red box.

New Growth

Most of the new growth came from industrial properties, which includes research and development (in Watertown’s case life science companies). That went up by $4.2 million. The biggest contributors were new developments that came online at 85 Walnut St. (more than $1 million), Arsenal on the Charles (more than $1 million), Arsenal Yards (more than $1 million), 99 Coolidge Ave. ($803,000), and 580 Pleasant St. ($791,000). Commercial went up $966,561, and personal property went up $708,029. Residential properties went up $477,496.

Smith believes new growth will continue to grow significantly next year. A year ago he projected that it would rise $4 million, and it came in at $6.35 million. He projects $6 million in new growth next year, and said he believes the number is solid.

“I’m going to let you in on a little secret. I always like to underpromise and overdeliver. People like people who do it like that,” Smith said. “When I say we are going to do $6 million (in new growth) next year, I am very confident we are going to do $6 million next year.”

See more details about the Watertown tax rates, new growth, and more in the City Assessor’s budget presentation by clicking here.

Considering the amount of commercial property being built in Watertown for the past 5 years, now the homeowner is told that their tax rates are going up, while commercial rates are going down? This is like living in the bizarro world. Only thing I can figure is that it’s part of the “Inflation Reduction Act”. You know, the solution to ease the huge rise of inflation, which hasn’t worked as of yet!

You are right, the tax rate for commercial, industrial and personal properties went down, but the average bill went up by nearly $10k, a 10.43 percent increase.

Thanks for the statement of facts in this matter Charlie.