Charlie Breitrose A lot of money was raised and spent on the 2015 Watertown Election.

Like Haley’s Comet or a cycle in baseball, a rarely seen event took place at the Watertown City Council meeting on Tuesday night: property taxes went down.

Watertown homeowners will see a drop of around $1,000 in their annual taxes this year.

The drop was primarily due to the Legislature passing special Home Rule legislation to allow Watertown to close a loophole in the law governing how much of the tax burden can be shifted from residential properties to commercial, industrial and personal (CIP) properties.

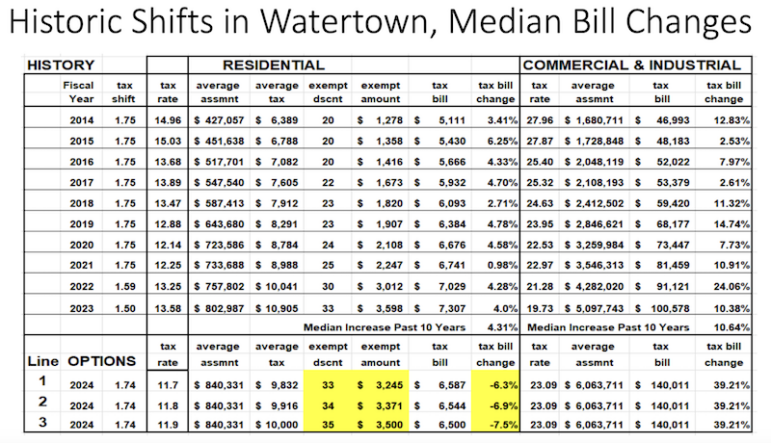

The tax rate on residential properties dropped from $13.58 per $1,000 in assessed value in Fiscal Year 2023 to $11.70 in Fiscal Year 2024, said City Assessor Earl Smith. Those who own their home in Watertown and make it their primary residence will save more.

“That is a substantial savings,” he said. “The average tax bill on a property with no residential exemption was $10,900 last year. This year it would be $9,800. Last year the residential exemption was $3,598. This year we project it to be $3,245.”

The average bill with the exemption will drop from $7,307 in FY23 to $6,587 in FY24.

Smith said the drop is for a good reason.

“There are three reasons a residential exemption goes down,” he said. “One is the Council votes less to exclude — that is not the case here. The second one is residential values going down, so have less of an exemption to exclude. That is not the cause here. The third reason it goes down is the tax rate is going down, and that is the best reason to have the residential exemption go down.”

Watertown has a split tax rate, and the state allows the City to shift up to 175 percent of the tax burden from residential to CIP. The law allowing the shift requires residential taxpayers to pay the greater of either 5o percent of value share of the levy, or the lowest percentage share of the tax levy they have paid since classification began, which is 61.24 percent.

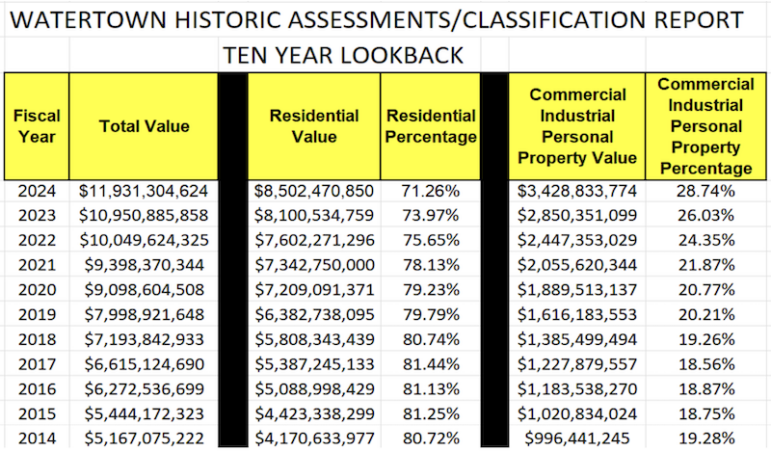

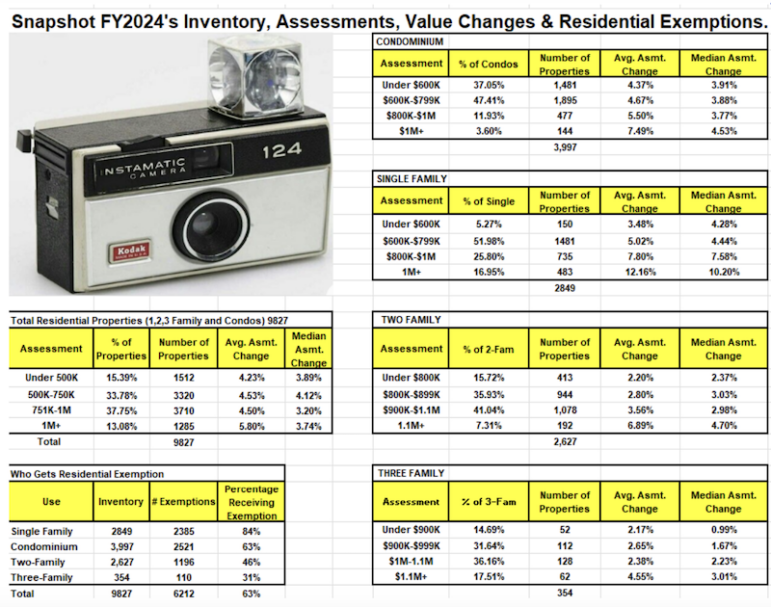

The values of commercial properties outpaced residential property values, shifting the ratio. The total value of properties in Watertown has more than doubled from FY14 when was $5.1 billion to FY24 when the total was $11.9 billion. In the past five years, commercial property values have jumped by about $1.5 billion. Even though residential values increased about $1.3 billion over the same period, the proportion of Watertown’s total property value went from 20.77 percent in FY20 to 28.74 percent in FY24.

In FY24, a few projects added about $7 million in new property value growth, Smith said: Arsenal Yards $2 million, Arsenal on the Charles $1.8 million, 99 Coolidge Avenue $1.2 million, 85 Walnut Avenue $1.2 million, and 66 Galen Street $737,000.

Using the 61 percent number for residential properties, Watertown could only shift 159 percent in FY22, and $150 percent in FY23. The Home Rule petition allowed Watertown to include more of the residential property value to be included in the shift.

“If the Council shifts the maximum allowed by law in Fiscal Year 2024, the shift will save the Residential taxpayers $33,665,310 (from FY23),” Smith said. “This amount is an additional $14,915,105 over last year’s amount of $18,750,205.”

The shift of the burden to the commercial, industrial, and personal property means a jump for those bills. The rate increased to $23.09 per $1,000 in assessed value in FY24, up from $19.73 in FY23. The rate had dropped from FY22, when the rate was $21.28.

The shift worked out to be 173.985 percent, Smith said, because Watertown hit the 50 percent limit.

Smith thanked Watertown’s elected officials in the State House for pushing the legislation through this year, after it died last session.

“The delegation worked diligently to get secure passage of this legislation,” Smith said. “A special thanks to Rep. Steve Owens. He did a tremendous amount of work with tremendous support of Rep. John Lawn and Sen. (Will) Brownsberger, who got this through the senate at breakneck speed. He did it in a day.”

Councilor Emily Izzo thanked former Councilor Anthony Donato, who she recalled proposed the Home Rule petition at her very first meeting in 2021. Smith said that Izzo and Councilor John Airasian persisted in making sure that the Assessors office was advocating for the legislation and moving through the process.

The Council approved the maximum shift from residential to CIP. It also approved a 33 percent residential exemption. They could have gone as high as 35 percent, but Smith said he believes it is good to have something left to adjust for the future.

“I think that this year we already have significant tax relief, but also we have already hit that 50/50 proposition,” Smith said. “We still have commercial development in play next year. We may not be able to shift 173 (percent), maybe 171 or whatever it is. This gives us room to try to offset the continued growth in the commercial, industrial, personal property class.”

After the presentation for the FY24 tax rates, resident Ann Marie Cloonan stepped up to the podium and said, “Thank you. … That’s it.”

Following the Council’s votes, City Council President Mark Sideris added his own thanks.

“Earl, usually when we do this we all hate you, but (this year) we love you,” he said.

See more details in the Assessor’s tax presentation slides by clicking here.

Very good news for the taxpayers of Watertown!